Our Blog

The New Retail Store: Click & Collect on the Big Stage for Festival Season

5 Min Read

Written by: Parcel Pending

Click & collect is now officially rock and roll. A move by food retailer Co-op proves it. The supermarket chain announced in May that its pop-up shops at three UK festivals this summer will provide revellers with the chance to use click & collect to buy their essentials. It’s not at this weekend’s Glastonbury but the service will be on offer to visitors to the Kendal Calling and Latitude events in July, having appeared at the Isle of Wight festival in June. It is giving festivalgoers a chance to pre-order their shopping and pick it up at a suitable time. More than 200 lines will be available for pre-order on Co-op’s online click & collect website, including food, beers, wines, and other refreshments. It’s the latest in a long line of industry developments proving click & collect is an efficient way for shoppers to pick up their goods, while being an operationally sound way for retailers to merge their bricks and clicks.

Click & collect as the saviour

Primark too is another retailer starting to dabble with the buy online, collect in-store model. It launched a new website in April, and although there was no e-commerce attached to it, click & collect has now been added to the menu. Primark continually batted away questions about when it would enter the online retailing arena but, on 20 June, click & collect was attached to the site – catapulting the value fashion retailer into e-commerce. Indeed, the new site launched with the option for shoppers to check stock by store, so the natural next step was to allow them to reserve it and collect the item in the shop?

It’s no surprise that Primark has reached this point. In the early days of the pandemic, it was forced to close its doors for a prolonged period of time, and because of a lack of e-commerce this meant it could not sell anything. Primark estimated it lost sales of £1.1 billion as a result of the temporary closures enforced on so-called non-essential retailers. Just think what it could have done if it has a click & collect option in place. Some retailers in the pandemic became click & collect-only operators for a period of time, such as Halfords and Next, and were able to keep the tills ringing in lockdown.

Indeed, activities in the pandemic have changed retailers’ thinking in general. As well as Primark, Poundland and B&M have long been part of the club of large UK retailers not getting involved in eCommerce – but times have moved on. Poundland acquired Poundshop.com in March to fast-track its online operations after trialling some localised services, while B&M – which doesn’t have e-commerce – has recruited a digital & omnichannel director, presumedly to explore developments in this area. We’ll see where those moves lead to in the month ahead.

Nothing new

While Primark, Poundland and B&M represent outliers in modern retail in terms of their slower e-commerce awakening, the wider industry has embraced web sales and click & collect over the last decade. Click & collect has a long history in UK retail, with the sweet spot for its emergence and wider adoption between 2012 and 2014.

Argos claims to have kick-started it at the turn of the millennium, but by around 2013 the general merchandise giant – alongside John Lewis and Next – were discussing the importance of click & collect’s impact on their respective festive sales. In the decades since, the supermarkets, then Screwfix and pretty much everyone else adopted the service as a way of driving consumer traffic to stores and providing added convenience to customers. Stationery, books, and gifts retailer The Works said in 2019 that click & collect was its fastest-growing channel, as the function of ordering online and picking up in person became common practice for consumers and recognisable parlance in marketing messaging. It’s now pretty much an expected service whatever a retailer is selling.

Modern click & collect

As we know, retail continues to change. Even online pure-play disruptor Asos, which was only established in 2000, says it is going through a digital transformation, which to me highlights how it is impossible to get by in this industry if you stop evolving and stand still.

And the same can be said for a retailer’s click & collect proposition. We’ve seen Next offer dedicated click & collect pods in supermarket car parks, and a few years back House of Fraser even opened its own click & collect-only stores, which lived a short life but perhaps were a bit ahead of their time.

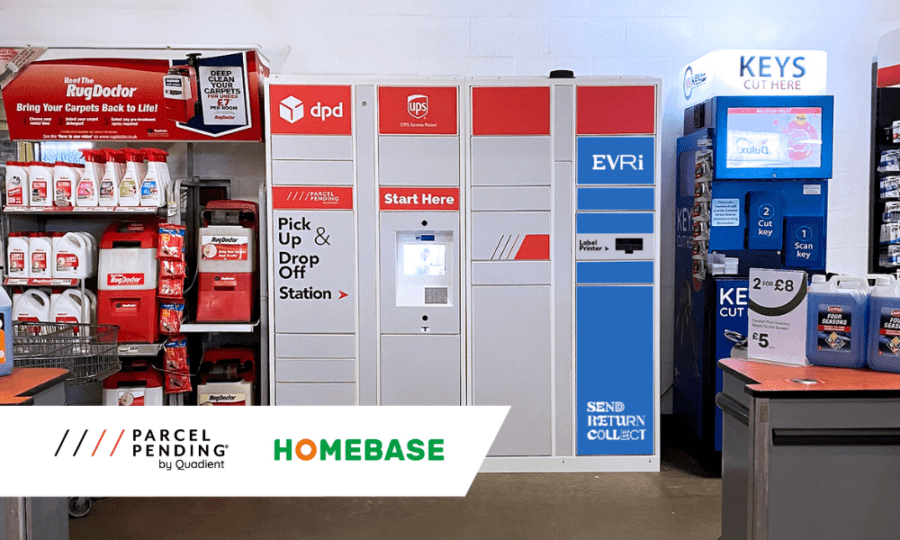

Toolstation is reportedly looking at the potential of click & collect-only stores with a drive-thru function, following the successful running of such a model in the pandemic. Argos – in Sainsbury’s stores – and Screwfix are effectively set up for click & collect above anything else too. But the extra modern click & collect twist that still has so much potential for growth in the UK, and which can help retailers from any sector, is the use of in-store lockers to hold online orders for consumers.

As they have done with retailers such as Decathlon in the UK and France, and Lowes in the US, Parcel Pending by Quadient retail lockers drive efficiency for the retailer and ultimate convenience for the customer. They help separate the functional online order pick-up mission from the experiential trip to the store, without making it about one or the other exclusively.

Incremental sales from walk-in online shoppers was always a perceived benefit of implementing click & collect in the early days. Now, with much more organised systems for click & collect, aided by easy-to-use self-serve lockers, that potential for upselling and basket building is an absolute reality. Retailers who install smart click and collect lockers within their stores report increased foot traffic and, more importantly, can see as much as 70% of customers go on to make incremental purchases.

A time-efficient experience may also encourage customers back. By automating the click and collect process, solutions like Parcel Pending smart lockers allow a customer to self-serve and retrieve an order in less than two minutes. This is important since a customer whose wait time is two minutes or less is four times more likely to purchase again and remain a loyal customer in the future.

It’ll be intriguing to see which direction Primark takes after deploying click & collect. It probably won’t be trialling at music festivals any time soon, like Co-op, but it’s a retailer e-commerce journey we’re intrigued to follow.