Retail

Retail returns: Is this the end of free returns?

Written by: Parcel Pending

5 Min Read

Published: September 12, 2022

Updated: January 29, 2025

Everyone in retail is talking about returns again.

From May, fast fashion retailer Zara started attaching a charge to customer returns – and then in July, online pureplay Boohoo announced any shoppers sending items back would be deducted £1.99 from their refund as a fee for returning goods.

Next and Uniqlo are two others in the fashion market that do not offer free online returns, despite it becoming a widely adopted policy among retailers to provide customers as an incentive to buy in the first place.

In June, Next raised the fee it charges customers returning items via couriers from £2 to £2.50, further highlighting a tightening up of retailer returns policy.

The argument for a returns fee

Both Asos and Boohoo have said recently that returns rates have escalated after the height of the pandemic.

People bought and returned fewer fashion items during lockdowns – but since society has opened up again, returns have picked up rapidly. The added cost pressures on UK consumers mean the option of returning goods is being taken up by more people, too, it seems.

Returns can be a significant drain on margins, and not all retailers have sophisticated reverse logistics processes and systems in place to counter that. There are plenty of industry stories suggesting some products never find their way back into stock and are either lost, thrown away, or sold at a lower cost through outlets and marketplaces.

Although Next charges for returns, we were amazed to learn in its August first-half trading statement that online returns rates are at 42% – almost half of everything that’s sold via e-commerce goes back!

Think of the operational costs involved in getting the product from A to B and from B to A again, and you can understand the business decision not to allow free returns. Costs need to be covered if you’re looking to drive profit.

Next’s latest online returns rates is only 1% higher than pre-Covid levels, suggesting less of an escalation in customers sending back items than at other retailers. Is the fact Next charges for returns a factor in this? It’s surely got to play a part. Zara’s decision to add a charge for goods sent back via third-party couriers will have been done with an eye on managing margins too.

There’s also the environment to think about, of course. Retailers have woken up to their responsibilities to the planet in the last 18 months, launching a plethora of rental, recycling, and repair initiatives – and rising returns is an additional R that doesn’t fit that agenda due to the unnecessary emissions and potential wastage associated with them. Discouraging returns = better for the environment.

The argument against

The other side of the argument is that customers expect free returns. You just have to take a look at the uproar caused on social media when Zara made its decision to add a charge – there’s a risk of putting customers off a brand, or stopping them from spending as much with you if you charge them to send back items. In fact, research suggests that nearly half (47%) of consumers wouldn’t shop with an online retailer that charges for online returns.

One could also argue that returns are the result of something else going wrong. Retailers need to do more to ensure customers make the right purchasing decision in the first place. Over the last decade or so there have been many online fit and sizing tech companies trying to push the envelope on this, but without seemingly being able to turn the tide on returns rates.

More needs to be done by retailers in order to get the transaction right the first time so that returns are not such a major issue. Many retailers already recognise this.

The verdict

Returns have always been a part of retail. The problem we seem to have now – and it’s accentuated by the rise of e-commerce over recent years – is they feel out of control and doing harm to businesses, consumer sentiment, and the planet in the process.

Sixty-six percent of consumers are more likely to buy something online if they can return it to a local store, therefore channelling returns through stores seems to be the sensible option. Indeed, as Zara said when introducing the charge for online returns, customers can still take unwanted items into shops for a full refund and no additional fee.

Next has never charged customers for taking online orders back to stores either. Pushing consumers towards returning to store, rather than posting their returns, would have benefits for the future of physical retail too, boosting footfall and presenting more opportunities for upselling and cross-selling when online customers head to shops. It would help foster a symbiotic relationship between bricks and clicks.

However, retailers don’t want to put effort into driving all that extra footfall if they can’t effectively manage the flow in store. If customers who are returning items are joining the queues and taking up staff time, they risk putting off potentially paying customers who need service.

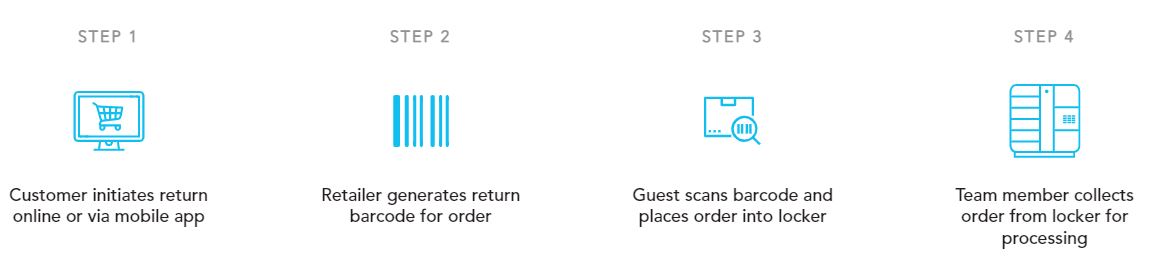

Retail smart lockers can facilitate this. Parcel Pending by Quadient lockers are already used by lots of leading retailers around the globe, including Decathlon and Lowe’s for click-and-collect orders and they have the functionality to facilitate returns too. Guiding customers who are collecting or returning online orders to do so via a smart retail locker optimises the process for all stakeholders. The store staff’s time is freed up from managing returns and instead they can focus on processing new purchases, the customers who need serving have more staff available to help them, and those who are returning orders can get in, return their order and back out of the store in less time (with Parcel Pending by Quadient it can take as little as 7-seconds to collect, or drop off an order!).

Jordan Byrd, Director of Retail Sales at Parcel Pending by Quadient says the key is to minimise the work the customer has to do. “The goal is to make returns simple. Let customers return to a locker system. They can scan a physical or digital receipt and then place their item into the locker.” That can work for in-store returns as well as e-commerce returns. “That’s the future,” she said. “It will be the most revolutionary innovation of 2022 for retail. It’s that important to the customer experience.”

How do order returns work with a smart retail locker?

Interested in learning more about how Parcel Pending by Quadient can help ease your returns burden? We’d love to chat, contact us today.