Retail

Retail returns: Is this the end of free returns?

5 Min Read

Written by: Parcel Pending

Everyone in retail is talking about returns

Since 2022, fashion retailers have begun charging customers for online returns, a move that has followed the increased costs surrounding the high influx of returns, an industry that is anticipated to reach $954 billion by 2029. Zara, H&M, JC Penney’s and Kohl’s are just some of the retailers who have begun to charge for online returns, with the fees expected to cover the cost of receiving, repacking, and cataloging of the returned goods.

As online shopping inherently involves an element of risk due to the inability to physically evaluate a product before purchase, the returns process is a critical post-purchase service that often influences consumers’ initial buying decisions. As the global reverse logistics market is projected to reach a value of $958.3 billion by 2028, retailers are grappling with the dilemma of whether to implement a return fee or provide free return services for customers. This has resulted in a significant number of retailers opting to charge customers for returns.

The argument for a returns fee

COVID-19 pushed customers to adopt online purchasing as a safe and convenient way to receive their goods. A trend that has continued to today, thanks to its convenience. But following the end of lockdowns and COVID-19 regulations being lifted, consumers have continued to buy online versus the traditional in-store shopping route. As the number of orders and returns continues to grow, retailers are under pressure to maintain the convenient purchasing and return options that customers have come to expect, despite operating in a more challenging environment.

Returns can be a significant drain on margins, and not all retailers have sophisticated reverse logistics processes and systems in place to counter that. There are plenty of industry stories suggesting some products never find their way back into stock and are either lost, thrown away, or sold at a lower cost through outlets and marketplaces. Considering the operational expenses associated with transporting products from point A to B and then back from B to A, it becomes evident why businesses opt not to offer free returns. To ensure profitability, these costs must be covered.

There’s also the environment to consider. Retailers have become increasingly aware of their responsibilities to the planet, prompting them to introduce various rental, recycling, and repair initiatives. However, the escalating number of returns poses an additional challenge that doesn’t align with this sustainability agenda, as it leads to unnecessary emissions and potential wastage. Discouraging returns = better for the environment.

The argument against

The other side of the argument is that customers expect free returns. You just have to take a look at the uproar caused on social media when a brand makes a decision to add a charge – there’s a risk of putting customers off a brand or stopping them from spending as much with you if you charge them to send back items. In fact, research suggests that nearly half (47%) of consumers wouldn’t shop with an online retailer that charges for online returns.

One could also argue that returns are the result of something else going wrong. Retailers need to do more to ensure customers make the right purchasing decision in the first place. In the past decade or so, numerous online fit and sizing technology companies have emerged, striving to revolutionize this aspect. However, it appears that despite their efforts, they have been unable to effectively reduce return rates.

More needs to be done by retailers in order to get the transaction right the first time so that returns are turned from a cost of doing business, into a new opportunity to improve customer satisfaction and sustainability efforts to drive brand loyalty.

The verdict

Returns have always been a part of retail. The problem we seem to have now – and it’s accentuated by the rise of e-commerce over recent years – is that retailers are experiencing new challenges in building out new strategies for returns that drive customer loyalty and improve sustainability initiatives.

Sixty-six percent of consumers are more likely to buy something online if they can return it to a local store, therefore channeling returns through stores seems to be the sensible option. And while many retailers are charging for returns, customers still have the opportunity to return in-store for a full refund and no additional fee. Pushing consumers towards returning to the store, rather than mailing back their returns would have benefits for the future of physical retail by boosting footfall and presenting more opportunities for upselling and cross-selling when online customers head in-store. This would help to foster a symbiotic relationship between in-store and online shopping.

Nonetheless, retailers are hesitant to invest effort in driving extra footfall if they cannot adequately handle the flow of customers in-store. When customers returning items join the line and consume staff time, it runs the risk of discouraging potential paying customers who require assistance.

How smart lockers facilitate improved returns

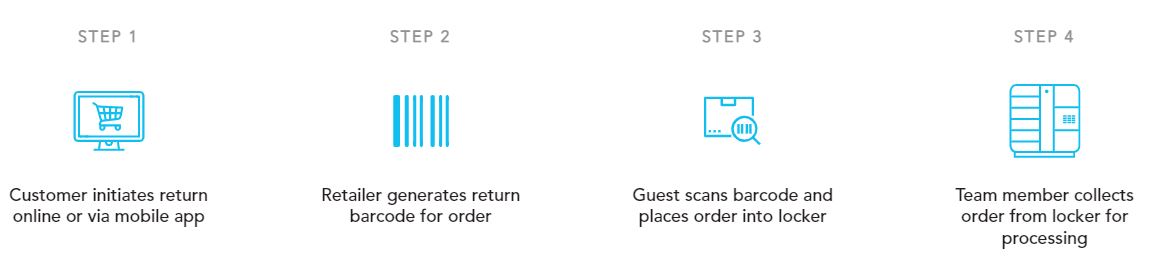

Parcel Pending by Quadient lockers are already used by many leading retailers around the globe, including Decathlon and Lowe’s for Buy Online, Pick-Up In-Store (BOPIS) orders, and have the functionality to facilitate returns too. By directing customers to collect or return online orders through a smart retail locker, the entire process is optimized for all parties involved. This approach allows store staff to be relieved from the burden of managing returns, enabling them to concentrate on processing new purchases. Customers in need of assistance benefit from having more staff available to help them, while those returning orders can swiftly enter the store, complete their returns, and exit in a shorter amount of time. With Parcel Pending by Quadient, this process can be as quick as 7 seconds to collect or drop off an order.

Austin Maddox, EVP Sales and Operations, NORAM at Parcel Pending by Quadient says that the key is to minimize the work the customer has to do. “The goal is to make returns simple. Let customers return to a locker system. They can scan a physical or digital receipt and then place their item into the locker.” That can work for in-store returns as well as e-commerce returns. “That’s the future,” he said. “It will be the most revolutionary innovation of 2023 and beyond for retail. It’s that important to the customer experience.”

How do order returns work with a smart retail locker?

Interested in learning more about how Parcel Pending by Quadient can help ease your returns burden? Contact us today!